3 Important Things You Need To Know About Cashback Cards

Table of Contents

High-limit cards, credit cards, prepaid cards… There are so many options these days and yet, there’s nothing as attractive as a card that gives you part of your spending back. It’s no wonder that cashback cards are so popular.

They aren’t just for spending money – they are also one of the best ways to save money!

According to Forbes, people are struggling more than ever to get some cash saved because of inflation. Two out of three people spend their entire salary without saving anything. And it’s not just inflation that influences this.

ResearchGate reports that a quarter of the households in the US don’t have any savings – and this dates years back. Knowing this, cards of this sort are a more-than-welcome method for putting some cash back into their bank accounts.

Still, there’s a lot to learn about these cards before you make your choice. Which one is best for you? Will you get the most value or will the fees bring you losses and not gains? Is every provider safe to use?

In this article, you’ll learn the answers to all these questions and more.

What is a cashback card?

Cashback cards are cards that allow you to earn rewards when you make purchases with them. The percentage you get back can vary based on different things from which card provider you use to what or how frequently you’re buying.

In many cases, cashback rewards won’t come in the form of actual cash. You’ll be given miles and points and sometimes even physical rewards.

Different programs will value the points and miles differently, too. This depends on how you redeem them, how many points you have, how frequently you use the card, etc.

You might even find cards that don’t offer cashback throughout the year but have this option only during selected periods, such as holidays, festivals, etc. More importantly, there will be cards that will limit this option to selected stores. If you don’t buy in those stores, you won’t get cashback.

As you can see, cashback cards aren’t as straightforward as you thought. This is why you need our guide – to find the perfect card with the best terms for you.

The things you can get with a quality cashback card

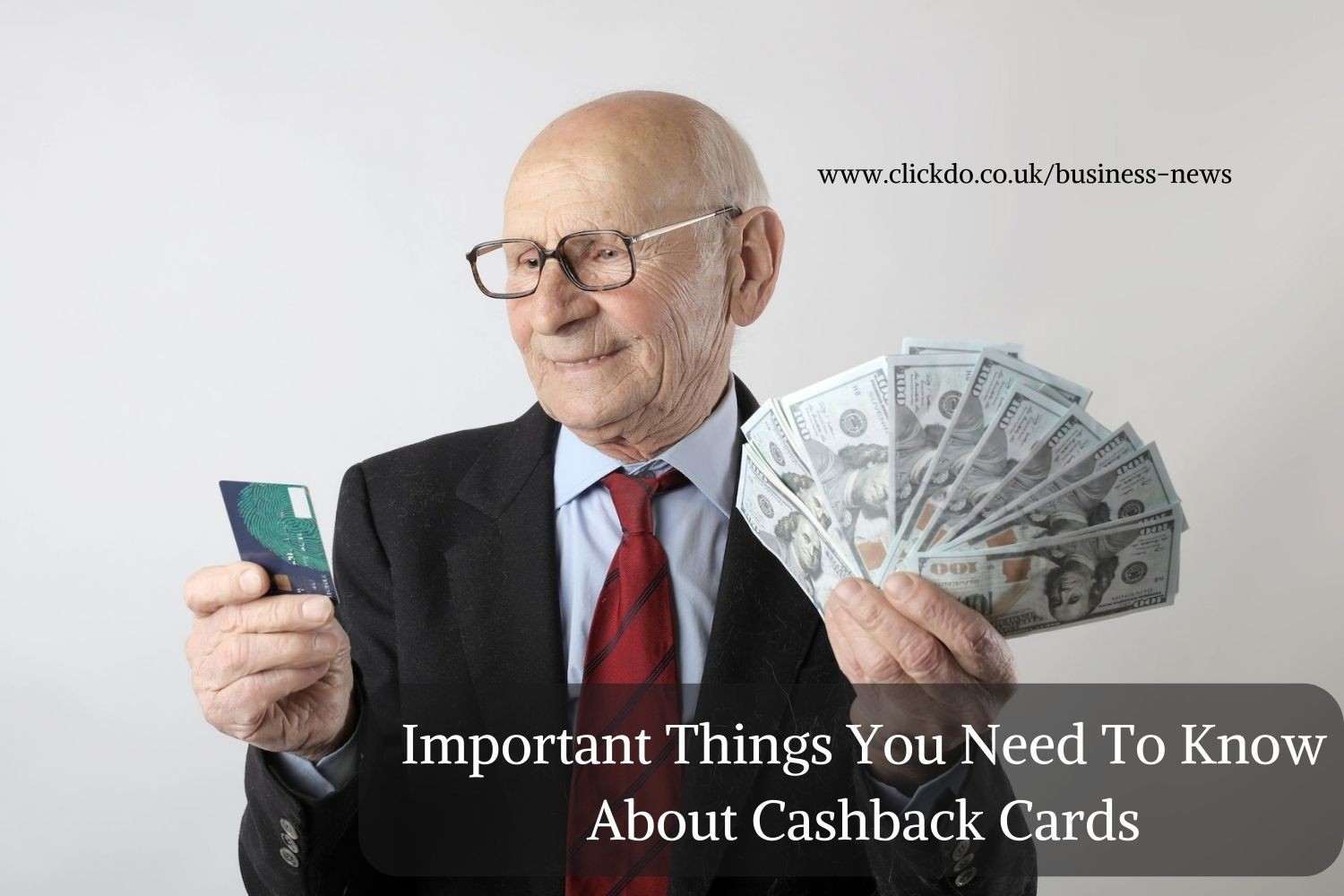

Cashback cards with good programs have plenty of benefits to offer their users. This card from Juni is a perfect example of that. Instead of limiting you to a few stores, Juni has a card that gives you cash back on everything you buy with it!

This card is focused on the e-commerce sector. If you want to have a profitable, good ecommerce startup that saves money when it spends money, Juni is a great way to boost its margins.

Users of Juni get 2% cash back on anything they spend for the first month, and up to 1% afterward. There are no caps to how much you can spend, so if you spend more, you get more back. The cashback is paid 30 days after each month-end, and this is guaranteed.

Juni is a good solution because it doesn’t offer random discounts and card points. They make it simple – you get cashback on everything you spend throughout the calendar month. The money is added to your account automatically, so all you need to do is use it!

3 things you should know about cashback cards

This is an important decision to make and as such, you need to know as much as you can about cashback cards. Let’s go through the most important information.

1. There are three main types of cashback cards

Cashback cards can fall into 1 of 3 categories. It’s important to know which category you’re using because this will tell you how much you can get back. For example, there’s a big difference between flat-rate and bonus cards.

Want to know what it is?

The 3 types of cashback cards are:

- Flat-rate cashback cards

- Bonus cash-back cards

- Rotating cashback cards

Here is all you should know about the 3 types of cashback cards:

Flat-rate cashback cards

Flat-rate cashback cards are pretty straightforward. These are the most preferred option among users. If you have a credit card with a flat rate cashback, this means that you’re getting the same percentage no matter where or what you buy.

When they first appeared on the market, you could get a maximum of 1% with a cashback card. These days, you can get more – even up to 2% as is the case with Juni.

The simplicity and the option to get money on everything are certainly alluring. The percentage might not be high as you might find with bonus cards. However, if you make all your purchases with a flat-rate cashback card, you will most likely get more cash back in the long run.

Bonus or tiered-rate cashback cards

Tiered-rate cashback cards allow you to get more money on specific types of purchases. They base the percentage on the category. For example, you might get a high cashback if you spend money on gas, but lower cashback if you spend it on travel.

Depending on the car you are using, the higher-earning tiers can come with limits. There’s a certain amount you can get back and if your spending exceeds it, the rest will be forfeited. For example, if a card offers you 3% cashback in one category but limits this to $50 per purchase, you won’t get more than $50 even if you spend thousands of dollars at the store.

While the percentage in tiered-rate cashback cards is higher for selected categories, the flat rate for the remaining purchases is often very low – or sometimes even non-existent. The idea is to get more cashback from higher rate categories and that would offset the very low rate from every other purchase you make.

Rotating cashback cards

Rotating cashback cards often have the highest rate in the bonus categories. This will look very tempting, but these cards require the most effort to get some money saved. Many people avoid this type of cashback. Why is that?

Rotating category cashback cards can come with as much as 5% money return. Their categories are not fixed, though, so they can differ greatly from today to tomorrow or next month.

Basically, these are like tier-based cards since you get high cashback only on selected categories.

The reason why people find these a bit frustrating is that they are not at all predictable. They also require action on behalf of the user. You need to constantly keep track of the updates of the provider and activate the new bonus cashback each quarter by opting in from your account. If you skip this step, you’ll get a very low cashback that is offered on all other purchases.

The trickiest part about these cards is that they have cashback caps like the previous category, but if you exceed the capped amount, they’ll give you lower cashback.

2. Cashback isn’t always money

When you see ‘cashback’ this doesn’t always refer to actual cash you’ll get back. It’s really misleading, which is why you should always read the fine print.

Still, this doesn’t mean that you won’t like what the card providers give you back.

Generally speaking, you’ll find cashback in the following forms:

- Actual money back – you get a deposit straight to your bank account

- Gift cards – gift cards to spend at retailers and restaurants or discount cards for selected stores

- Statement credit – covers some of your debt on the credit card

- Travel points – you can use your cashback only to travel and redeem it on hotels and flights

3. Every cashback program has different terms

Using a cashback card can be very profitable, but only if you know and follow the rules of the provider. It’s wise to check the terms and conditions for each program you want to use. For example, you might jump at the opportunity to get a 5% cashback only to find out later that you need to spend a thousand dollars before you can redeem anything.

The terms and conditions will also tell you about your redemption options. In most cases, this is straightforward. However, there are some cards that will ask you to redeem your cashback to a specific method or in a specific way to get the most out of it.

For example, a card can require you to get your rewards in an e-wallet. If you want to withdraw to your bank, you’d have to pay a fee.

This goes on and on. Some cards will limit the number of times you can withdraw your cashback, while others will give it to you directly to your bank account. There are cards where you can only get your cashback once or twice a year!

Lastly, you should learn all you can about the fees. Cards with good cashback often have higher annual fees. If they offer great terms, this will help you earn more to offset the annual fee and save money.

Are you ready to save some money?

Cashback cards can be a great way to boost your savings. The idea of getting money back when you spend is popular for a reason, but this will only work if you pick the right card for you. Hopefully, this guide helped you gain a better understanding of how cashback cards work.

Author bio

Nadica Metuleva is a freelance writer who is passionate about creating quality, original content. She holds a master’s degree in English teaching and a bachelor’s degree in translation. With 8 years of experience in the freelance writing industry, Nadica has become proficient in creating content that captivates the audience, drives growth, and educates. You can find her on LinkedIn.

Nadica Metuleva is a freelance writer who is passionate about creating quality, original content. She holds a master’s degree in English teaching and a bachelor’s degree in translation. With 8 years of experience in the freelance writing industry, Nadica has become proficient in creating content that captivates the audience, drives growth, and educates. You can find her on LinkedIn.